What Is A Bridge Loan? – The Basics

Introduction

Bridge loans can be an incredibly useful financial tool for businesses and individuals looking to get access to capital quickly. However, it’s important to understand what exactly a bridge loan is and how it works before making any decisions. In this blog post we will explore the basics of bridge loans, including what they are, when they should be used, and what makes them different from other types of financing. We will also cover some of the key considerations you should make before taking out a bridge loan, so that you can make an informed decision that best suits your needs.

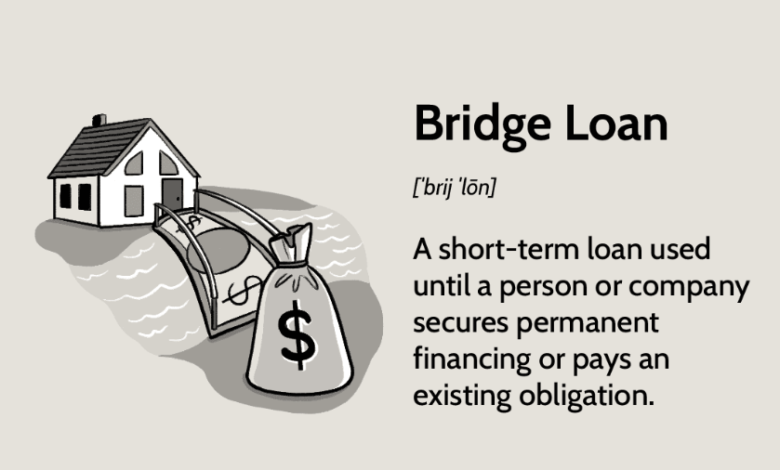

What is a bridge loan?

A bridge loan is a type of loan that is typically used to finance the purchase of a new home before the borrower’s current home has sold. Bridge loans are short-term loans that have terms of up to one year. They are typically interest-only loans, which means that the borrower is only required to make payments on the interest during the term of the loan. At the end of the term, the balance of the loan is due in full.

Bridge loans can be used for a variety of purposes, but they are most commonly used to finance the purchase of a new home before the borrower’s current home has sold. In this case, the bridge loan allows the borrower to access the equity in their current home and use it as a down payment on their new home. This can be an attractive option for borrowers who do not have enough cash on hand for a traditional down payment.

Bridge loans are also often used to finance renovations or repairs on a new home. In this case, the bridge loan can be used to access equity in the borrower’s current home, which can be used to pay for renovations or repairs on their new home. Once again, this can be an attractive option for borrowers who do not have enough cash on hand to pay for these costs upfront.

Bridge loans can be beneficial for borrowers who are looking to purchase a new home before their current home has sold because they can provide access to needed funds quickly

How do bridge loans work?

A bridge loan is a type of short-term loan that is typically used to finance the purchase of a new home before the borrower’s current home is sold. Bridge loans are usually interest-only loans, with the borrower making monthly payments on the loan until the borrower’s current home is sold. The borrowed funds can then be used as a down payment on the new home.

Bridge loans can be an attractive option for borrowers who are looking to buy a new home but have not yet sold their current home. Bridge loans can provide access to funds that might otherwise be unavailable, allowing borrowers to purchase their new home without having to wait for the sale of their current home.

However, bridge loans also come with some risks. Because they are typically interest-only loans, borrowers will accrue interest on the loan balance from the day the loan is originated. This can add up to significant costs over time if the borrower’s current home does not sell as quickly as anticipated. In addition, bridge loans are typically short-term loans with terms of one year or less, which means that borrowers will need to find another source of financing once their current home is sold. For these reasons, it’s important for borrowers to carefully consider whether a bridge loan is right for them before moving forward.

Pros and cons of bridge loans

Assuming you’re asking for a general overview of the pros and cons of bridge loans:

A bridge loan is a short-term loan used to provide financing during a transitionary period – typically when you are selling one home and buying another. Bridge loans are popular in today’s market because they offer several advantages:

PROS

-Allows you to buy a new home before selling your old home

-Gives you more time to find the right buyer for your old home

-Can be easier to qualify for than other types of loans

CONS

-You’ll need to make two mortgage payments each month until your old home is sold

-Bridge loans typically have higher interest rates than conventional mortgages

-You may be required to pay additional fees if your old home doesn’t sell within a certain timeframe

Types of bridge loans

Bridge loans are typically short-term loans with maturities of up to one year. They are generally used to fill a financial gap between two transactions. Such as the sale of a home and the purchase of a new one. Bridge loans can be secured by a variety of collateral, including real estate, vehicles, or personal property.

There are several types of bridge loans available to borrowers. The most common type is the closed-end bridge loan. Which allows the borrower to take out a loan for a specific period of time. And then repay it in full at the end of that term. These loans usually have interest rates that are higher than traditional loans because they are considered to be high-risk. Another type of bridge loan is the open-end bridge loan, which provides the borrower with access to additional funds. If needed before the end of the original loan term. These loans typically have lower interest rates than closed-end bridge loans because they are considered to be less risky.

In some cases, borrowers may also be able to obtain a bridge loan through their lender. This type of loan is known as a portfolio loan. And can be used when the borrower has multiple properties that they are trying to finance. Portfolio loans can be either closed-end or open-end and usually offer lower interest rates than other types of bridge loans.

Alternatives to bridge loans

There are a few alternatives to bridge loans that can be considered. When looking for financing for a real estate project. One option is to take out a conventional loan from a bank or other financial institution. This type of loan can have a fixed or variable interest rate and terms that range from 5-30 years. Another option is to get a home equity loan or line of credit. This can be a good choice if you have equity built up in your home. And you need cash for a down payment on another property.

The interest rates on these types of loans are usually lower than those of bridge loans. But they may require monthly payments and have shorter repayment terms. Finally, some investors choose to finance their projects with personal savings or by using credit cards. This can be risky, as there is no guarantee that the project will be completed. And the debt must be paid back regardless. But it can be an option for those who cannot qualify for traditional financing.

How to get a bridge loan

If you’re a homeowner, you may have heard of a bridge loan. Bridge loans are sometimes used by people who are buying a new home before selling their old home.

Here’s how it works: let’s say you’ve found your dream home, but you haven’t yet sold your current home. You can’t get a traditional mortgage because you don’t have enough equity in your current home. So, you take out a bridge loan against your current home to finance the purchase of your new home. Then, once you sell your old home, you use that money to pay off the bridge loan.

Bridge loans can be a great option if you’re sure you can sell your old home quickly. And for enough money to pay off the loan. But they can be risky: if your old home doesn’t sell as quickly as you hoped. Or for less than expected, you could end up owing more than the value of both homes.

If you’re considering taking out a bridge loan. Talk to a qualified financial advisor to make sure it’s the right decision for you.

Conclusion

Bridge loans are a great way to provide temporary financing without selling off assets or taking on additional debt. They can be used for a variety of purposes such as purchasing new property. Making improvements to an existing property, expanding a business, investing in capital projects, and more. However, it is important to understand the risks associated with bridge loans before entering into any agreement. Although these short-term loans may seem like an attractive option due to their fast underwriting process. And relative ease of access to funds when compared with traditional loan options, they come with higher interest rates. And repayment terms that must be adhered too in order to avoid defaulting on the loan. As such it is wise for those considering bridge lenders do their research thoroughly before entering into any agreements.